How to Write a Check the Right Way (Even in 2025)

Learn how to write a check correctly in 2025. Step-by-step guide with tips on filling out every line to avoid mistakes and keep your payments secure.

In an age where you can pay for almost anything with a tap of your phone or a click of a mouse, the idea of writing a paper check can feel like a lost art. It’s 2025, and while online banking dominates our daily transactions, the humble check is far from obsolete. Whether you're paying rent to a landlord, covering a down payment, paying a government fee, or giving a formal monetary gift, you'll inevitably face a situation where a check is the best—or only—option. Knowing how to fill one out correctly is a crucial life skill that ensures your payment is secure and processed without delay.

If you're staring at a blank check feeling a bit uncertain, you've come to the right place. This guide is designed to show you exactly how to write a check the right way. We’ll break down every field step-by-step, from the date to the signature line, demystifying the process so you can fill out your next check with complete confidence and avoid common, costly mistakes.

How to Fill Out a Check The Right Way & Avoid Common Mistakes (2025 Tutorial)

"Enjoy this curated video. All rights and credit go to the original YouTube creator."

Are Writing Checks Even Necessary?

Writing a check might feel like a lost art in today’s world of mobile banking and instant payments. But here’s the truth: checks are still alive and well. Landlords, small businesses, and even government offices often rely on them. And if you’ve never written one before, or it’s been years since you last did, the process can seem confusing. The good news? It’s incredibly simple once you know the flow.

Why It Matters

You may not use checks every day, but when you need one, you’ll be glad you know how. Checks are still used to pay rent, settle bills without online portals, or send money to people who don’t use digital wallets. On top of that, properly written checks help protect you against fraud and errors. Mastering this basic financial skill keeps you prepared, professional, and confident.

Step-by-Step: How to Write a Check

Step 1: Date the Check

Look at the top right corner of the check. That small line is where you enter today’s date. Always write it out clearly—month, day, and year—so there’s no confusion later. Some people try to postdate checks, but unless you’ve worked that out with the payee, stick to today’s date.

Step 2: Write the Payee’s Name

Next, move to the line that starts with “Pay to the order of.” This is where you write the full name of the person or company you’re paying. Avoid nicknames or abbreviations. If it’s a business, copy the name exactly as it appears on the bill or invoice.

Step 3: Fill in the Amount in Numbers

On the small box to the right, enter the exact amount using numbers. For example: $125.50. Be sure to start writing all the way at the left edge of the box so no one can add extra digits.

Step 4: Write the Amount in Words

Directly below the payee line, there’s another line for writing the same amount, but this time in words. For example: One hundred twenty-five and 50/100 dollars. The written amount is what the bank relies on if there’s ever a mismatch, so double-check this part.

Step 5: Add a Memo (Optional, But Smart)

At the lower left corner, you’ll see a memo line. This is where you jot down the reason for the check. It’s optional, but it makes bookkeeping easier. For example, you might write “April Rent” or “Invoice #4521.”

Step 6: Sign the Check

Finally, at the bottom right, sign your name exactly as it appears on your bank account. Without your signature, the check isn’t valid. Think of this as the seal that makes the whole document official.

Pro Tips & Common Mistakes to Avoid

Don’t leave blank spaces. Always start writing amounts at the far left edge of the box and line. If there’s extra room, draw a line after your entry so nothing can be added. Also, avoid writing in pencil or erasable ink—use a standard blue or black pen. And most importantly, make sure your signature matches what your bank has on file. Even a small variation can cause a rejection.

Real-Life Example

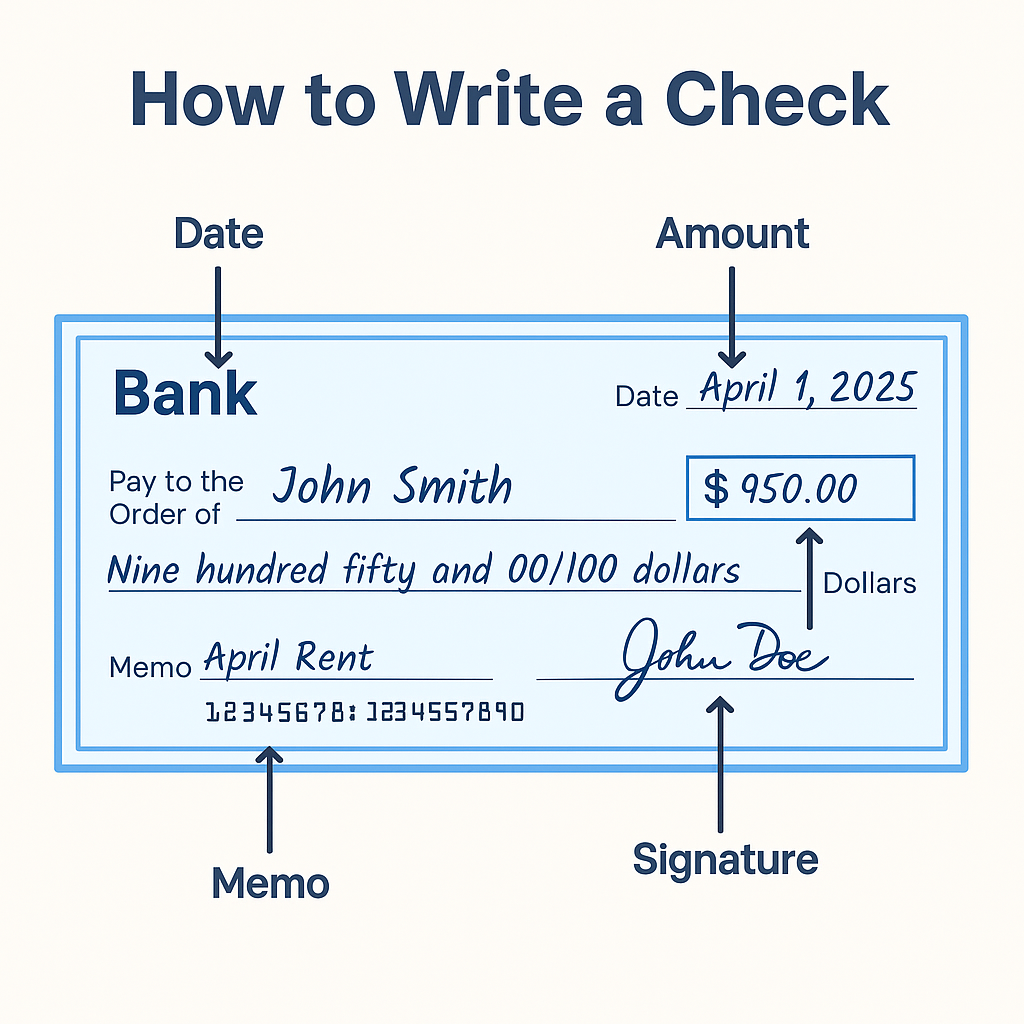

Imagine you’re paying your landlord $950 for rent. Here’s how your check would look:

- Date: April 1, 2025

- Pay to the order of: John Smith

- Numeric amount: $950.00

- Written amount: Nine hundred fifty and 00/100 dollars

- Memo: April Rent

- Signature: [Your Signature]

When you hand it over, everything is clear, neat, and professional—just the way banks like it.

Quick FAQs

Do banks still accept checks in 2025?

Yes. While digital payments dominate, checks are still widely used, especially in rent, business, and government transactions.

Can you write a check in pencil?

No. Only use ink—preferably black or blue—so your check can’t be altered.

What happens if I make a mistake?

If you catch it before signing, void the check by writing “VOID” across it, then start fresh with a new one.

Conclusion

Writing a check might feel old-fashioned, but it’s one of those life skills that will never go out of style. Whether you’re paying rent, sending a gift, or settling a bill, knowing how to properly fill one out saves you from awkward mistakes and keeps your finances secure. Now the next time someone asks you to “just write a check,” you’ll know exactly what to do.